News

Stay up to date with everything that’s been going on with Centroid and around the trading world

What is a Connectivity Bridge?

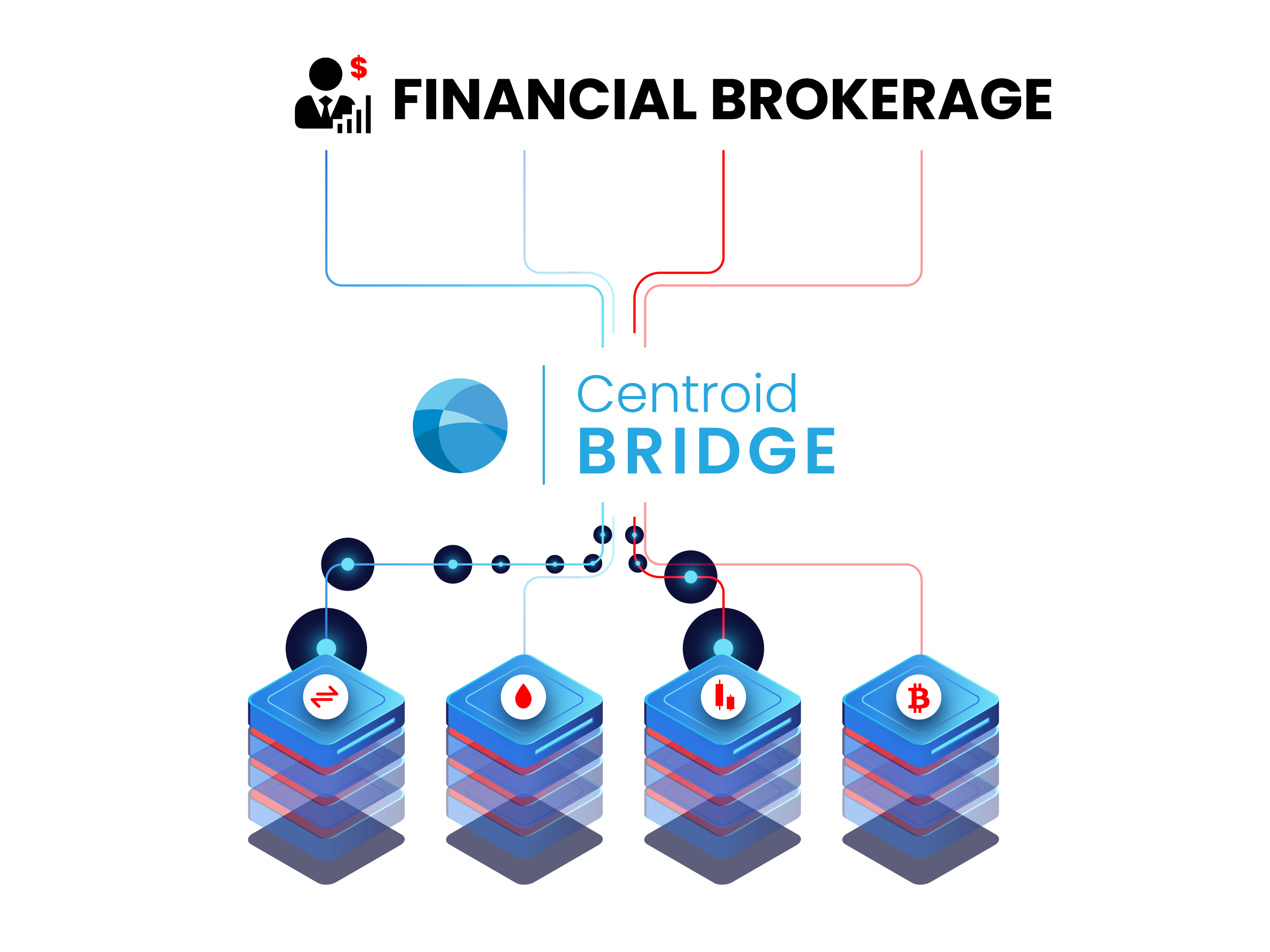

In essence a connectivity bridge is a system that facilitates the exchange of financial messages (real-time price updates and financial transactions) between trading counterparties. It is a core component of the infrastructure of any financial brokerage, as without it, real-time financial transactions would not be possible. In addition to this however, connectivity bridges are currently delivering an extensive set of other functionality.

Functionality of Connectivity Bridges

First of all, connectivity bridges are supporting a wide and expanding range of liquidity sources and venues, across multiple asset classes, spanning from prime of primes, prime brokers, crypto exchanges, market data providers and aggregators. Multiple such providers are part of the setup of any given broker, with an overall combined offering of thousands and thousands of products. Moreover, the liquidity from various sources can be aggregated together, creating more competitive books of liquidity for customers. Additional sophisticated liquidity management mechanisms are part of the usual feature set to help customize and optimize a broker’s offering and trade routing flows. To facilitate the best performance and lowest latency under such conditions, connectivity bridges are running on specialized hardware and network infrastructure, deployed in key locations, in close proximity to liquidity and trading venues.

The same complexity also applies towards the connectivity with trading platforms (Such as MT4, MT5, cTrader, and more). Brokers offerings are spanning across multiple platforms, exchanges and frontends, which are usually completely independent and oblivious of each other. It is the responsibility of the bridging technology to support and connect all such platforms, facilitate pricing and order execution to each from a centralized control system, in a consistent or fully customized manner, leveraging the liquidity connectivity established at bridge level.

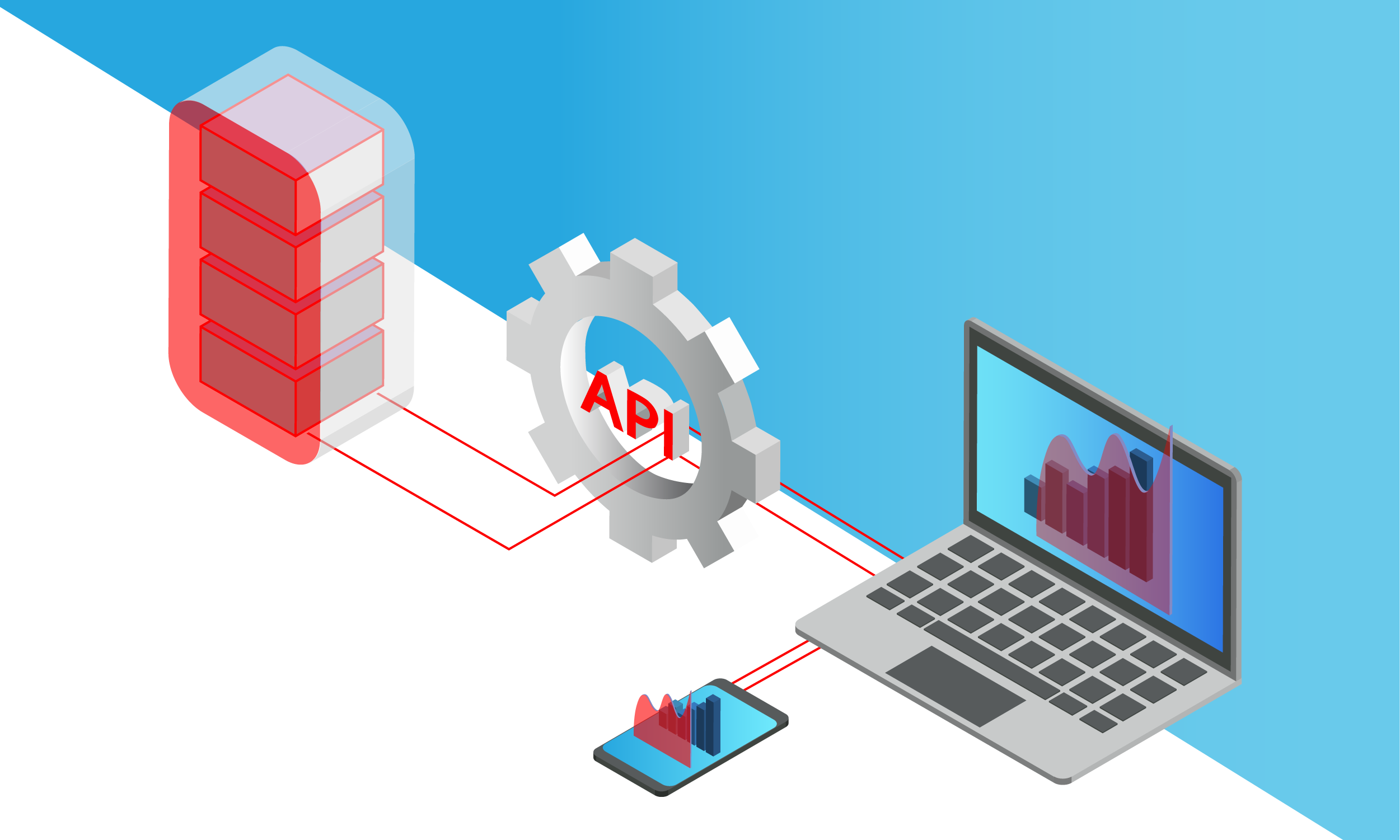

Additionally, bridging systems have the ability to provide connectivity via APIs (FIX APIs, REST APIs, etc.), directly to any other counterparty. This enables entities to be liquidity venues and distribute their liquidity to other brokers. Thus, a financial institution can make use of the bridging technology to cater both to a retail audience and create additional revenue streams through a B2B offering at the same time. Alternatively, entities can focus only on an institutional offering, using the bridging technology standalone, without any trading platforms, through the APIs and functionality available directly within the engine. To support this, the connectivity bridges have had to incorporate complex features including trading accounts with real-time positions and PnL, pre-trade margin controls and account liquidation methods, daily charges, statements and full customer level reporting, and so on, spanning across a multi-asset offering. This has been expanded also with client level trading interfaces, usually web and mobile based, where the trading counterparties have the ability to manage their account, positions, trade and in essence any action related to a trading account.

With such different business requirements within one system, it is highly important to be able to flexibly define and manage multiple liquidity models and offerings, for different business segments and customer types. And moreover, such offerings can be changed dynamically, either programmatically via APIs, based on a custom defined logic of the broker, or under different time sessions or market conditions. Multiple execution models can be defined and customized, following market making, ECN or hybrid models, with smart order routing rules at product level. And regarding the product set, connectivity bridges have incorporated functionality to help expand a broker’s offering, allowing to create new synthetic products, offer 24/7 trading (i.e. weekend trading) and accept trading in fractional amounts on products. In turn this has led to higher interactions between brokers and their customers and increase client engagement.

Another function of critical importance is the storing and processing of market and trading data. As we have seen above, all product offerings of a financial institution are originating within the connectivity bridges and all transactions are passing through such systems. Thus the bridging technologies have developed comprehensive reporting capabilities to process and provide important insights to the business: market data stats and comparisons, trading stats related to earnings, rejections, fill statistics, statements, positions evolution, and much more. All such reports can be accessed in real-time, and APIs have been developed for easy integrations to various external systems, BI dashboards and real-time post trade reporting and data analysis.

Risk Management Functionalities Added to Bridge Solutions

Importantly, bridging technologies have incorporated advanced risk management functionality, analysing in real-time the huge quantities of data flowing through the system, producing business intelligence, risk analytical insights and notifications. Additionally the systems have the ability to take actions based on the real-time risk analytics following complex defined business logic. This is essential in today’s trading landscape as many financial brokers struggle with the absence of an all-in-one risk management framework that monitors the entire company’s trading operations and produces data-driven analytical results and actions, on a fully automated real-time basis. And many entities are currently using multiple trading platforms and services developed by different vendors which very often either completely lack or include only a subset of risk management functionalities specific only to that trading technology and isolated from the other trading platforms. In addition, those systems do not have an out-of-the-box functionality to exchange data freely amongst one another. As a result, the trading data is fragmented across different systems, causing brokers to perform substantial amount of time-consuming manual work, just to aggregate a complete picture about the risks involved. This shortcoming results in a time-lag for critical risk related decisions based on current exposure dynamics.

The connectivity bridges have essentially been perfectly positioned to “bridge” this gap, by offering the ability to measure overall risks in real-time at the level of asset class, currency, USD notional, concentrations, and flow toxicity, which is vital for identifying and mitigating risks in a timely manner, especially during times of high market volatility.

Obviously, having to handle so many core aspects of a financial entities’ operations has put more and more emphasis on the scalability of a bridging technology. Such systems must deliver performance, high throughput and be very versatile. Additionally, the usability is also very important, with bridges being able to accommodate configuration changes in real-time, on-the-fly, such that new business opportunities can be satisfied, and setups can be furthered, without an impact on existing business. And last but not least such engines must be very stable and reliable, with built-in redundancy at all levels, avoiding downtime and sub-optimal performance at all costs.

Find out more from Centroid Solutions

One of Centroid Solutions’s core solutions is the Connectivity Bridge, Centroid Bridge, if you’d like to find out more about our technology solutions, please fill in the Contact us form or email us on [email protected] to find out more.