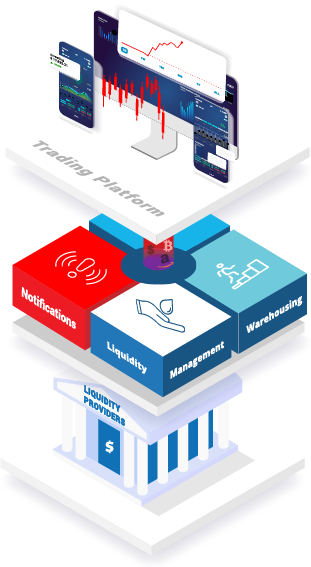

Connectivity Engine You Can Trust

Centroid Bridge offers a dedicated centralized environment, supporting connectivity to any number of trading platforms, FIX APIs, and 200+ liquidity sources. It includes sophisticated tools for managing connectivity with liquidity providers, customizing pricing and execution services, for retail and institutional clients.

The engine is hosted on dedicated custom servers to support the high demands of financial trading, located in our dedicated infrastructure, in close proximity of liquidity providers’ pricing engines, in Equinix LD4 (London), NY4 (New York) and TY3 (Tokyo) datacenters.

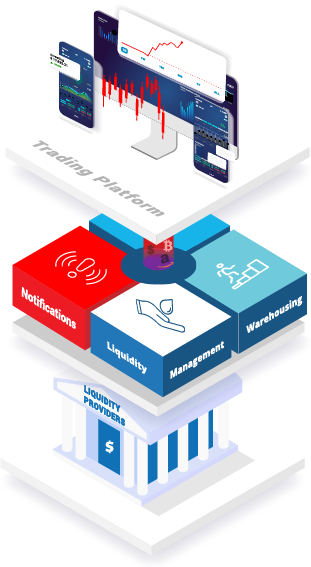

How the system works

01.

Connect chosen liquidity provider(s) to the Centroid Bridge engine.

(each liquidity source will have it’s own dedicated API connection)

02.

Connect your trading platform(s) to the Centroid Bridge engine.

(each trading platform connects either via API or Centroid Bridge plugin)

03.

Configure, control, manage and monitor all pricing and trading settings for the entire trading environment from a centralized location.

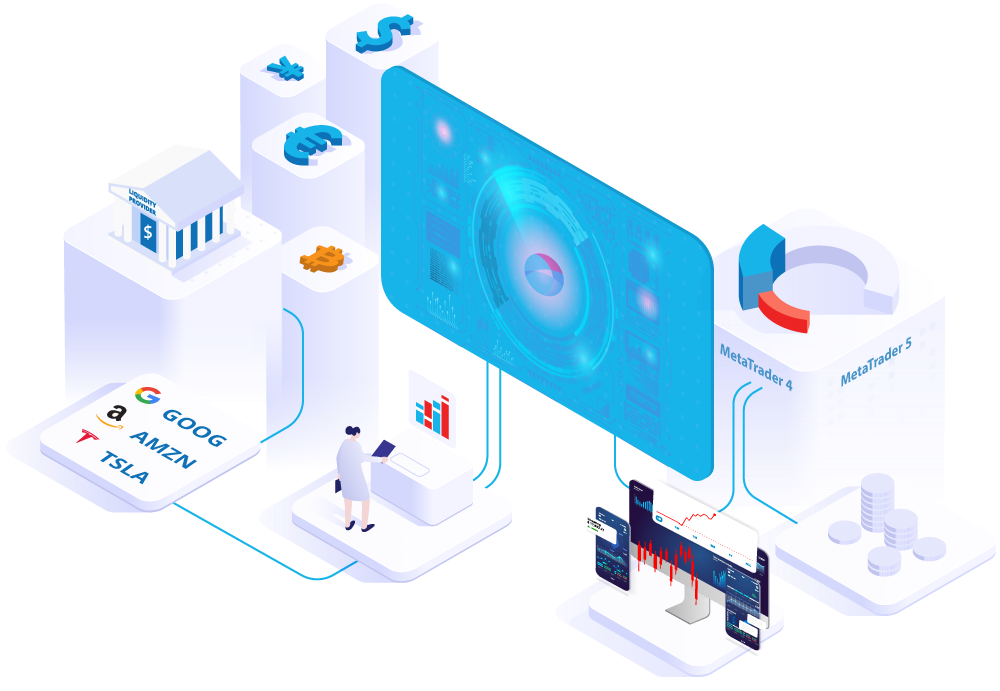

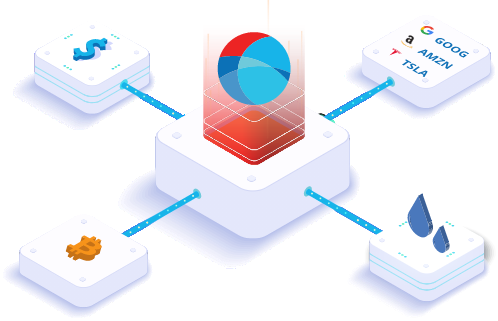

Freedom of Choice

Expand your business with your choice of multi-asset LPs (for FX, CFDs, Stocks, Cryptos, NDFs, etc.), unhindered by connectivity and technology restrictions or expensive processing fees.

Freedom of Choice

Expand your business with your choice of multi-asset LPs (for FX, CFDs, Stocks, Cryptos, NDFs, etc.), unhindered by connectivity and technology restrictions or expensive processing fees.

Benefit from

Unique Features

Centroid Bridge is the core to support broker’s evolution.

The engine is a feature-packed connectivity solution that is built to provide brokers with the infrastructure and tools to grow their business. Moreover, all configurations and settings can be made instantly, from the user-friendly UI (supporting multiple languages), to meet immediate business demands.

Risk Management aspects are also considered and integrated into the system, giving brokers the ability to fulfill their PnL targets, through various risk-adjusted settings and add-ons.

Universal

Connectivity Engine

All trading platforms and APIs are seamlessly connected to a dedicated engine, facilitating low-latency access to over 200 multi-asset liquidity venues. MT4, MT5, cTrader, DXTrade, VertexFX and FIX APIs are all supported.

Multi-Asset Class

Execution and Distribution

Extensive integrations available with venues and exchanges, facilitating full multi-asset capabilities (for FX, CFDs, Metals, Indexes, Commodities, Equities, Cryptos, NDFs and Futures), allowing brokers to expand their product range and revenue streams.

Liquidity

Management

Flexibly define multiple liquidity models for every instrument and time based, from dedicated streams to aggregation or custom liquidity layers and spreads, to accommodate different business requirements and revenue streams.

Highly Customizable

MT4 / MT5 Routing Rules

Define flexible routing rules on MT4 Bridge / MT5 Gateway, to manage order execution for STP, warehouse or hybrid mode, at the group or even individual customer or symbol levels.

Advanced Warehousing

Capabilities

Powerful warehousing engine with customizable settings and advanced execution controls, for effectively operating a hybrid business model.

Quant-based

Hybrid Execution

Integrated with Centroid Risk, to automatically detect various risk factors, STP unwanted trades based on pre-defined risk parameters and quantitative risk analytics.

Market

Impact Analysis

Powerful engine to assess the toxicity of client’s flow and determine how to best manage it from risk, execution and liquidity offering perspective. Run across entire customer base or deep dive into individual accounts, time frames and symbols.

Trading

Panel

Provide brokers with additional option to place orders via the in-house trading panels, with Market Watch to show the full market depth from each liquidity source, visualize and compare in real-time the liquidity models created for different customer groups.

Trade

Copier

Ability to allow brokers to direct or reverse copy client’s trades onto C-book with flexible settings and give-up copied trades to external MT4/MT5 accounts for monitoring purposes.

System Monitoring

and Alerting

Pricing, Trading and overall System status are actively monitored, with real-time alert notifications, logs and audit reports for early detection and prevention of potential issues.

Comprehensive

Reporting System

Comprehensive reports can be generated via the system’s UI covering all pricing and trading aspects, providing full visibility and insight into the trading activities of the company.

Extensive Data

Export Tools

Pricing and Trading data can be exported to external systems, in real-time via Give-up Rules and Drop Copy APIs, or requested at any point in time via REST APIs.

Want to know more?

Let’s talk.

"*" indicates required fields