Analyze, Identify, Mitigate

Centroid Risk offers a convenient GUI interface to monitor and analyze the company’s risk exposures, PnL and all trading activities in real-time, based on data-driven intelligent technology, from one centralized environment. It produces comprehensive risk management and risk analytical insights, risk alerts, complex simulations and stress-testing on trading data with forecasting capabilities, hedging and other recommendations for actions, and decision-making business reports.

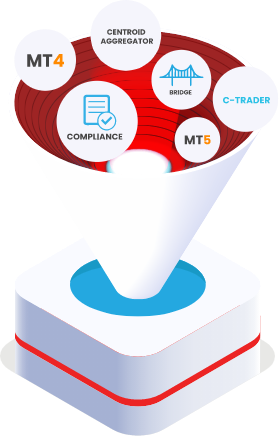

How the system works

01.

It simultaneously connects to multiple trading platforms and execution systems used by brokers, such as: MetaTrader 4, MetaTrader 5, cTrader, FIX compliant platforms, and bridges.

02.

It aggregates huge amount of raw trading data from platforms and bridges and analyzes the data on a real-time basis.

03.

It produces comprehensive data-driven risk management and risk analytical insights, risk alerts and action suggestions, helping to proactively identify, quantify and mitigate unwanted risks in a timely manner.

Benefit from

Unique Features

The ability to proactively identify and mitigate market risks within the portfolio is vital for ensuring strong business sustainability and optimizing performance under any market conditions. Centroid Risk completely eliminates the need for manual time-consuming data crunching, by automating the production of in-depth risk management and analytical information essential for the trading desk, risk officers and executives of the company, to help keep everything under control and hedge risks before things get too serious.

Advanced Exposure

Monitoring

Monitor true net exposure (in lots, underlying and USD notional) after all A-book and C-book positions, at underlying, instrument, asset class levels.

Value at

Risk Analysis

Measure and quantify portfolio market risk level. Set your portfolio VaR risk tolerance limits, and receive recommendations for entry and exit from hedges to stay within the limits.

Stress

Testing Engine

Predict the impact of market gap scenarios on the total company performance, for selected instruments or entire portfolio. Forecast negative balances, triggered resting orders, company P&L and net exposure.

Portfolio

P&L Analysis

Real-time complete PnL breakdown: A, B, C Books, revenue fees and expenses, net P&L, volumes and performance stats, at portfolio and instrument levels.

Clients

Risk Profiling

Auto-detect arbitrage and other types of aggressive or suspicious trading activities. Track any combinations of risk factors at the level of portfolio, clients and trades.

Risk

Alerts

Real-time streaming risk notifications and alerts about any kind of defined risk factors and analytical results produced by the software at the level of portfolio, instruments, clients and trades.

Business Reports

Fully customizable decision-making business reports, for any historical period. Detailed company risk and performance reports, clients profitability, symbols profitability, revenue, trading stats, A, B, C Books, etc.

Want to know more?

Let’s talk.

"*" indicates required fields