News

Stay up to date with everything that’s been going on with Centroid and around the trading world

Understanding the Difference Between Cross-Connects and Internet Connectivity.

In financial trading, where milliseconds can make a significant difference, speed is everything. Prices can update several times per second, and liquidity is offered on a first-come, first-served basis. If your order reaches the liquidity provider even slightly later than others, you risk missing the best available price or having your order filled partially or not at all. This can result in slippage, rejections, or unfavorable execution. Since liquidity is shared across market participants and is not unlimited, traders are constantly competing for access to the same pool. In such a time-sensitive environment, having the right connectivity isn’t just an advantage, it’s a necessity. That’s why it’s crucial to understand the difference between standard Internet connectivity and dedicated cross-connections, especially in the context of financial trading and server hosting solutions.

Let’s explore these two options and how Centroid’s network infrastructure leverages cross-connects with liquidity providers (LPs) to deliver exceptional benefits to its clients.

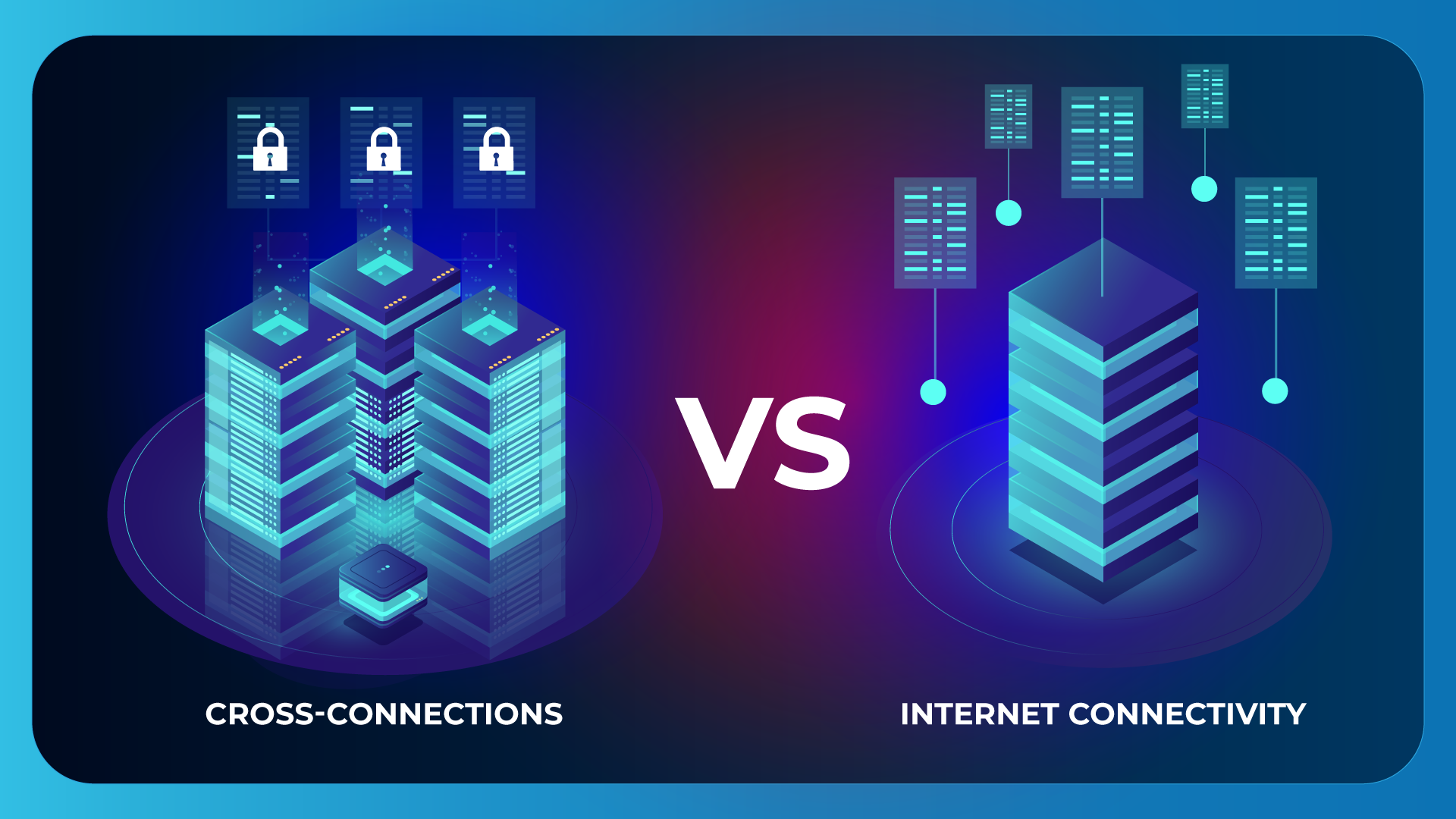

Internet Connectivity vs. Cross-Connections

When evaluating connectivity options for financial trading, both pricing and trading performance play critical roles. Let’s take a closer look at how Internet connectivity and cross-connections stack up in these two areas.

Internet Connectivity:

- Real-time Pricing Performance: Internet connectivity typically comes with lower upfront costs because it utilizes shared infrastructure provided by Internet Service Providers (ISPs). However, hidden costs arise from latency issues, packet loss, and downtime, which can negatively affect trading profitability.

- Trading Performance: Internet connectivity is prone to variable latency, network congestion, and performance fluctuations due to its shared nature. In trading, this variability can lead to delayed trade executions, slippage, or even missed opportunities during volatile market conditions. The public nature of the connection also makes it more vulnerable to security threats, which could disrupt trading operations.

Cross-Connections:

- Real-time Pricing Performance: Cross-connections involve a dedicated physical link between the trading infrastructure and liquidity providers’ infrastructure. While this option has higher initial costs, it delivers greater long-term value by eliminating the hidden costs associated with poor performance, latency, and reliability issues. For financial trading, this option is a must as it prioritizes speed and precision.

- Trading Performance: Cross-connections provide ultra-low latency, consistent performance, and enhanced security. In financial trading, where milliseconds matter, these advantages allow for faster, more reliable trade execution, reducing slippage and increasing profitability. The private nature of cross-connections ensures that sensitive financial data is protected from cyber threats, offering a stable and secure trading environment.

Established cross-connections are especially important in the event of volatile financial market events, because of:

- Increased pricing activity, where the number of price updates grow exponentially

- Increased in trading activity as more orders will come through as the market becomes more volatile

These are the conditions where the brokers do not want to have slippage, missed opportunities, rejections, latency, etc.

Due to the nature of the cross-connection, the dedicated environments with huge potential throughput, that is when cross-connection shines as it has the capability to handle the above issues, much better than the Internet.

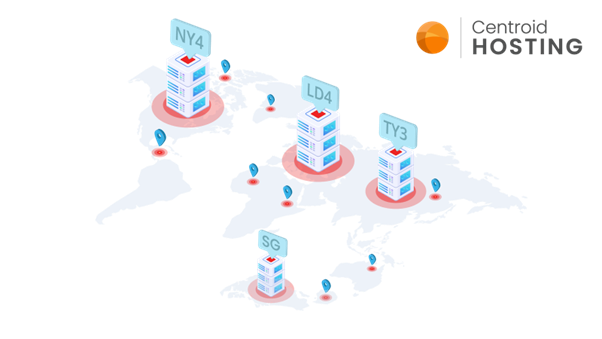

Benefits of Centroid Hosting Solutions

Centroid Hosting Solutions is designed specifically to cater to the stringent requirement of financial trading under any market volatility conditions, and the institutional-grade network infrastructure has numerous cross-connections with various liquidity providers (LPs) and cloud infrastructure providers, making it a cost effective and feature-packed solution. Here are some key benefits for clients:

- Lowest Latency Performance: The cross-connections ensure that clients can access liquidity providers with minimal delay, which is crucial for trading activities where every millisecond counts.

- Enhanced Reliability: By utilizing dedicated connections, clients can avoid the potential disruptions associated with public internet traffic, ensuring a more stable trading environment.

- Optimal Performance: Centroid’s infrastructure is tailored for high performance, allowing clients to execute trades efficiently and effectively.

- DDoS Protection: The hosting infrastructure is built to withstand DDoS attacks, providing an additional layer of security for clients’ operations.

By leveraging Centroid Hosting Solutions, clients can significantly enhance their trading capabilities and overall business performance, benefiting from the dedicated connectivity already in place with a large number of liquidity sources.